On Saturday, May 3, East Baton Rouge Parish voters will decide whether to authorize a new property tax to fund the District Attorney’s office. Below is what you need to know before casting your ballot.

1. Ballot Language

Shall the 19th Judicial Enforcement District of the Parish of East Baton Rouge, State of Louisiana (the “District”) be authorized to levy and collect a tax of four (4) mills on all the property subject to taxation in the District (an estimated $24,400,000 reasonably expected at this time to be collected from the levy of the Tax for an entire year) (the “Tax”), for a period of twenty (20) years, beginning with the year 2025 and ending with the year 2044, in accordance with Louisiana law, with the proceeds of the Tax (after paying reasonable and necessary costs and expenses of collecting and administering the Tax) to be dedicated and used for the purpose of providing funding for the office of the District Attorney for East Baton Rouge Parish?

2. Why the Tax Is Proposed

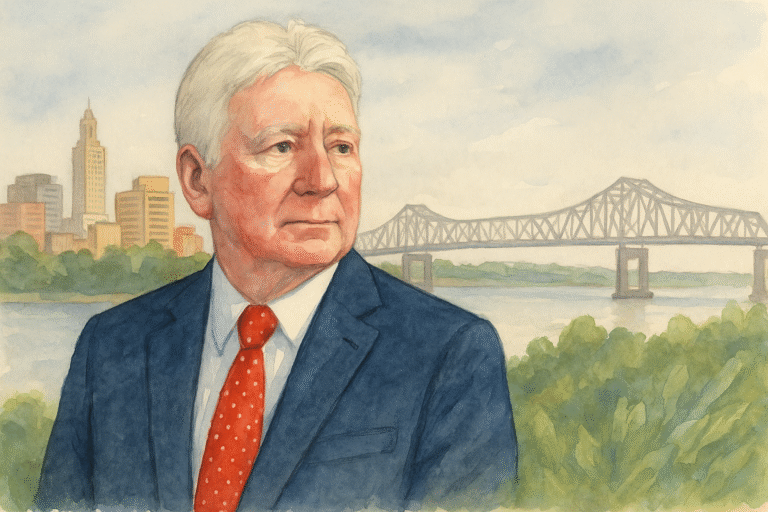

Mounting Backlogs: DA Hillar Moore reports roughly 230 pending homicide cases, and over 11,000 total cases awaiting trial, straining his current staff of 53–58 assistant DAs.

Regional Comparison: Neighboring Jefferson and Orleans parishes employ around 75 and 80 assistant DAs, respectively—far more than Baton Rouge’s office.

Revenue Needs: The tax is expected to raise roughly $24–$26 million annually—up from the office’s current $16.2 million budget—to hire prosecutors, victim-witness coordinators, analysts and investigators.

3. Financial Impact on Homeowners

Rate & Duration: A levy of 4 mills ($4 per $1,000 of assessed value) over 20 years, from 2025 through 2044.

Cost Example: On a $100,000 home (before exemptions), this adds about $40 per year (about $3.33 per month).

Parish-Wide Effect: The overall millage rate would rise from 51.30 to 55.13 mills, translating to roughly $500 more annually on a $200,000 home with the standard $75,000 homestead exemption.

4. Arguments in Favor (“Yes” Vote)

Reduce Delays: More prosecutors and support staff aim to clear backlogs and speed up both violent and nonviolent case processing.

Competitive Salaries: Funding would allow starting pay to rise closer to other large parishes — helping retain experienced attorneys and curb attrition.

Union Endorsements: Baton Rouge firefighters’ and police unions back the measure, citing dangerous staffing shortages.

5. Arguments in Opposition (“No” Vote)

No Performance Metrics: Establishing a protected revenue stream for the DA’s office without clear accountability or benchmarks.

Missed Holistic Approach: True community safety, they contend, requires investments in education, mental-health services, housing and violence-prevention programs—none covered by this tax.

“Tax Fatigue”: After recent defeats of local levies, many voters are wary of adding a permanent tax, especially one without guaranteed outcomes.

Prominent grassroots advocacy groups like the Power Coalition are among the notable opponents to the DA’s millage:

6. Next Steps

Election Day is Saturday, May 3. A simple majority “Yes” vote is required for passage.

If Approved: Moore’s office says it would immediately begin hiring roughly 15 additional prosecutors, boosting salaries, and expanding victim-assistance and analytical units.

If Defeated: The DA’s office would revert to annual city-parish budget requests — likely perpetuating staffing shortages and case delays, according to Moore’s office.

East Baton Rouge voters must decide whether this targeted 4-mill, 20-year tax is the most effective way to strengthen prosecutorial capacity—or whether a broader, community-centered public-safety strategy might better serve long-term crime reduction.